🌎 Dominican Real Estate Market 2026: Trends & Perspectives

The Dominican Republic continues to strengthen its position as one of the most dynamic and resilient real estate markets in the Caribbean. With tourism at record levels, new infrastructure projects unfolding across the country, and increased interest from foreign investors, 2026 is shaping up to be a milestone year for the property market.

Whether you’re considering Bayahibe & Dominicus, Casa de Campo, La Estancia Golf, or Punta Cana, the outlook for 2026 remains exceptionally promising. Here is a deep dive into the trends and perspectives that define the coming year.

📈 1. Tourism Growth Continues to Drive Real Estate Demand

Tourism remains the engine of the Dominican economy, and its continual expansion has a direct impact on the real estate market. As visitor numbers increase, so do rental demands, especially in short-term vacation properties.

⭐ Key points

• Record-breaking tourism arrivals

• Strong demand for Airbnb units

• Long-term rental market growing alongside expat communities

• Increased interest from North America and Europe

This momentum positions coastal zones like Bayahibe & Dominicus, Punta Cana, and Casa de Campo as prime areas for investors seeking consistent returns.

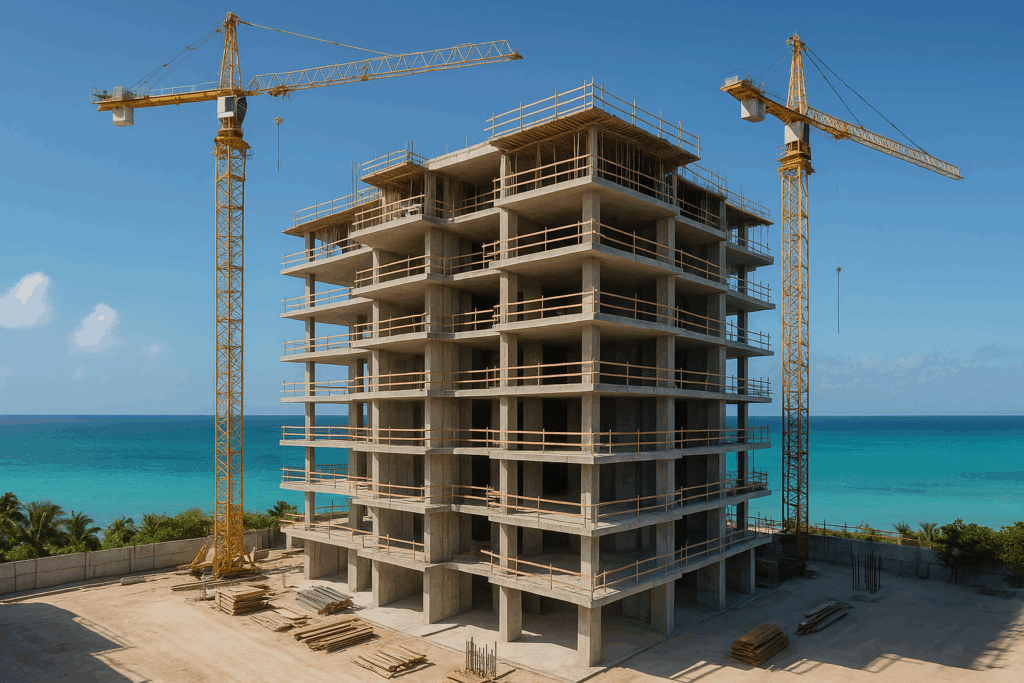

🏗️ 2. New Residential Projects Across Key Regions

Developers are responding to demand by launching modern condominium projects, villa communities, and mixed-use developments.

⭐ What’s trending in 2026

• Modern, resort-style condos

• Eco-friendly designs and energy-efficient homes

• Residences with hotel-like services

• Gated communities with enhanced security

Zones such as Punta Cana and Bayahibe & Dominicus continue to expand, while La Estancia Golf offers new opportunities for quieter, more affordable investments.

💸 3. Property Values Continue to Rise — but Remain Accessible

2026 brings a steady—but not excessive—increase in property prices.

The Dominican Republic remains notably more accessible than other Caribbean markets while still offering strong appreciation.

⭐ Why prices rise

• Increased foreign investment

• Upgraded infrastructure

• High demand for coastal properties

• Expansion of premium communities

For investors, this means excellent long-term appreciation without the inflated pricing seen in places like the Bahamas or Barbados.

🧳 4. Short-Term Rentals Remain a Strong Profit Generator

Thanks to high tourism demand, short-term rentals remain one of the most profitable investment models in 2026.

⭐ Strengths of short-term rentals

• High occupancy year-round

• Strong returns in Punta Cana and Bayahibe & Dominicus

• Preference for modern residences with amenities

• Increased interest in family-friendly villa rentals

Investors in Casa de Campo benefit from premium rental rates in the luxury segment.

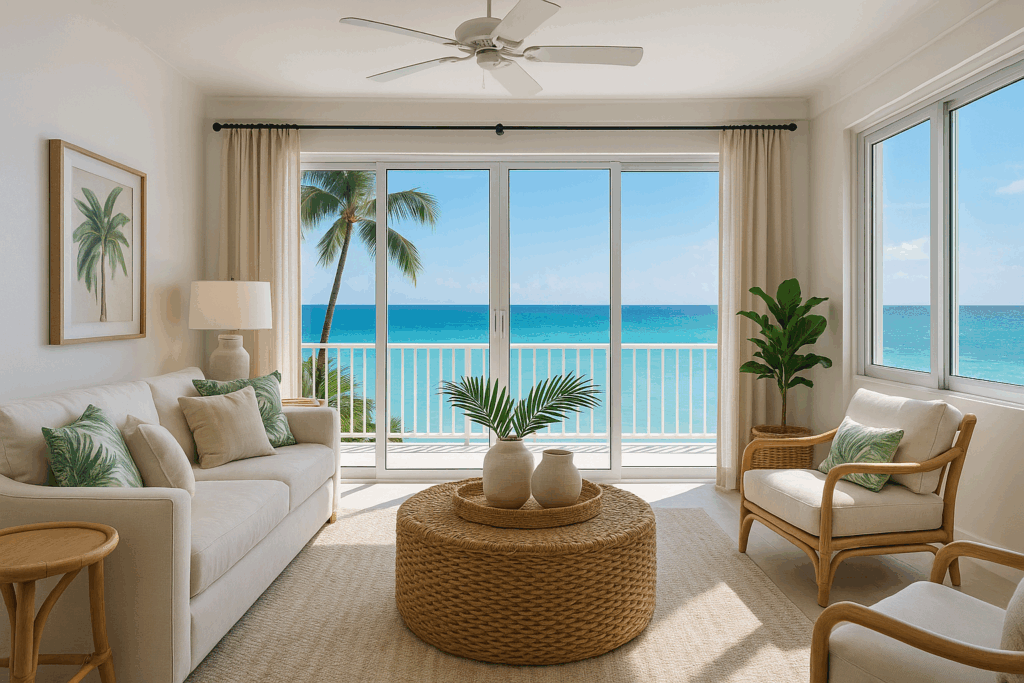

🌱 5. Lifestyle Communities Are in High Demand

People want more than a property — they want a lifestyle.

In 2026, buyers look for homes offering comfort, amenities, and a sense of community.

⭐ What buyers look for

• Pools, gyms, coworking spaces

• Proximity to beaches and marinas

• Golf course communities

• Wellness-centered developments

This trend directly benefits areas like La Estancia Golf and Bayahibe & Dominicus, where lifestyle and nature blend seamlessly.

🏦 6. The Dominican Republic Remains a Safe Investment Destination

Foreign investors continue to choose the Dominican Republic because it offers:

⭐ Stability & Legal Security

• Favorable laws for foreign buyers

• Full ownership rights

• CONFOTUR tax incentives

• Strong banking support

In 2026, the country reinforces its reputation as a transparent, accessible, and well-regulated market.

🔮 Conclusion: A Market That Keeps Moving Forward

With tourism growth, expanding development, and increasing global attention, the Dominican Republic’s real estate market is on an upward path in 2026.

Whether you’re looking for rental income, luxury living, long-term appreciation, or lifestyle investment, the country’s top regions — Bayahibe & Dominicus, Casa de Campo, La Estancia Golf, and Punta Cana — offer outstanding opportunities.

2026 is not just a good year to invest — it’s a strategic one.