🏝️ Airbnb Investment in the Dominican Republic — 2026 Complete Guide

How to maximize returns with Perez Real Estate

The Dominican Republic continues to stand out in 2026 as one of the most attractive destinations for Airbnb and short-term rental investments in the Caribbean.

Strong tourism demand, favorable property prices, a flexible legal framework and growing international interest make Airbnb a powerful investment strategy — when done correctly.

This guide explains where Airbnb works best, what returns investors can realistically expect in 2026, and how Perez Real Estate supports you at every step, from purchase to rental performance.

🌍 Why Airbnb Remains a Strong Strategy in 2026

Several structural factors support Airbnb growth in 2026:

- Tourism remains at historically high levels

- Travelers increasingly prefer apartments and villas over hotels

- Demand is diversified (vacationers, families, digital nomads)

- Entry prices remain competitive compared to other Caribbean markets

- Short-term rentals outperform long-term rentals in tourist zones

Airbnb is no longer experimental — it is a mature and data-driven market in the Dominican Republic.

✔️ Perez Real Estate role

We evaluate if Airbnb is the right strategy for your profile before you buy — not after.

📍 Best Airbnb Zones in 2026

Punta Cana — Highest Rental Potential

Punta Cana remains the strongest Airbnb market in the country.

- High year-round demand

- International flights and infrastructure

- Strong nightly rates in peak season

- Ideal for 1–2 bedroom modern condos

Expected performance (2026):

• Occupancy: ~45%–70%

• Gross yield: ~7%–10%

✔️ Perez Real Estate selects the most profitable micro-zones and avoids oversupplied areas.

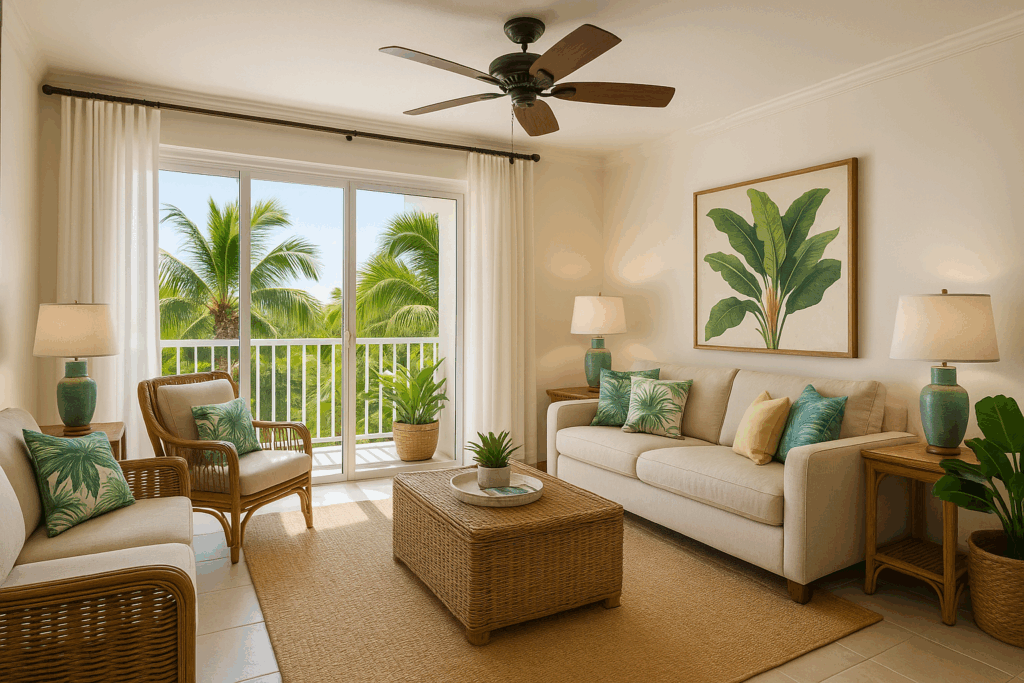

Bayahibe & Dominicus — Stability and Lifestyle Appeal

Bayahibe & Dominicus attract a different, very loyal type of guest.

- Families, couples, divers, long-stay visitors

- Calm beaches and authentic environment

- Excellent balance between occupancy and price stability

Expected performance (2026):

• Occupancy: ~50%–70%

• Gross yield: ~6.5%–9%

✔️ Perez Real Estate focuses on condos with long-term rental consistency, not volatility.

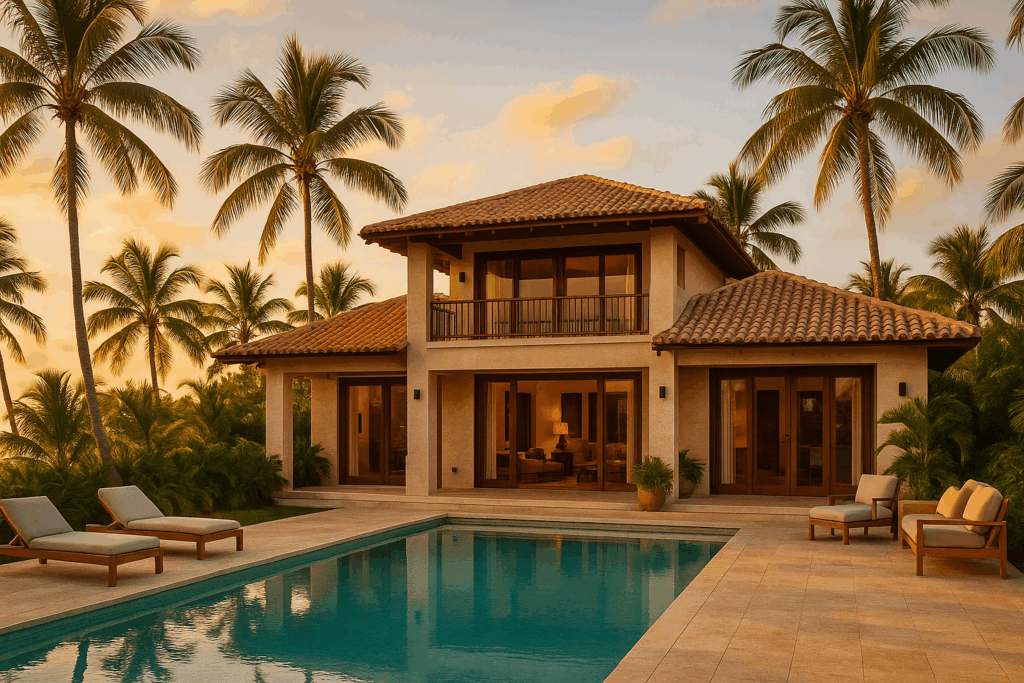

Casa de Campo — Premium Airbnb Market

Casa de Campo targets a high-end segment.

- Luxury villas and premium condos

- Golf, marina and private services

- Very high nightly rates

Expected performance (2026):

• Yield driven by nightly rate rather than occupancy

• Premium seasonal income

✔️ Perez Real Estate positions properties for high-value guests and specialized management.

La Estancia Golf — Long-Stay & Digital Nomads

This area is ideal for medium-term rentals.

- Quiet environment

- Golf lifestyle

- Attractive for digital nomads and retirees

Expected performance (2026):

• Occupancy: ~35%–55%

• Stable monthly income through longer stays

✔️ Perez Real Estate builds long-stay pricing strategies to reduce seasonality.

📈 What Returns Can Investors Expect in 2026?

Airbnb performance depends on location, property type and management quality.

Typical 2026 benchmarks

- Average occupancy: 45%–65%

- Gross rental yield: 6%–10%

- Peak season revenue: December to April

Airbnb consistently outperforms long-term rental strategies in tourist zones.

✔️ Perez Real Estate calculates net returns realistically, including all costs.

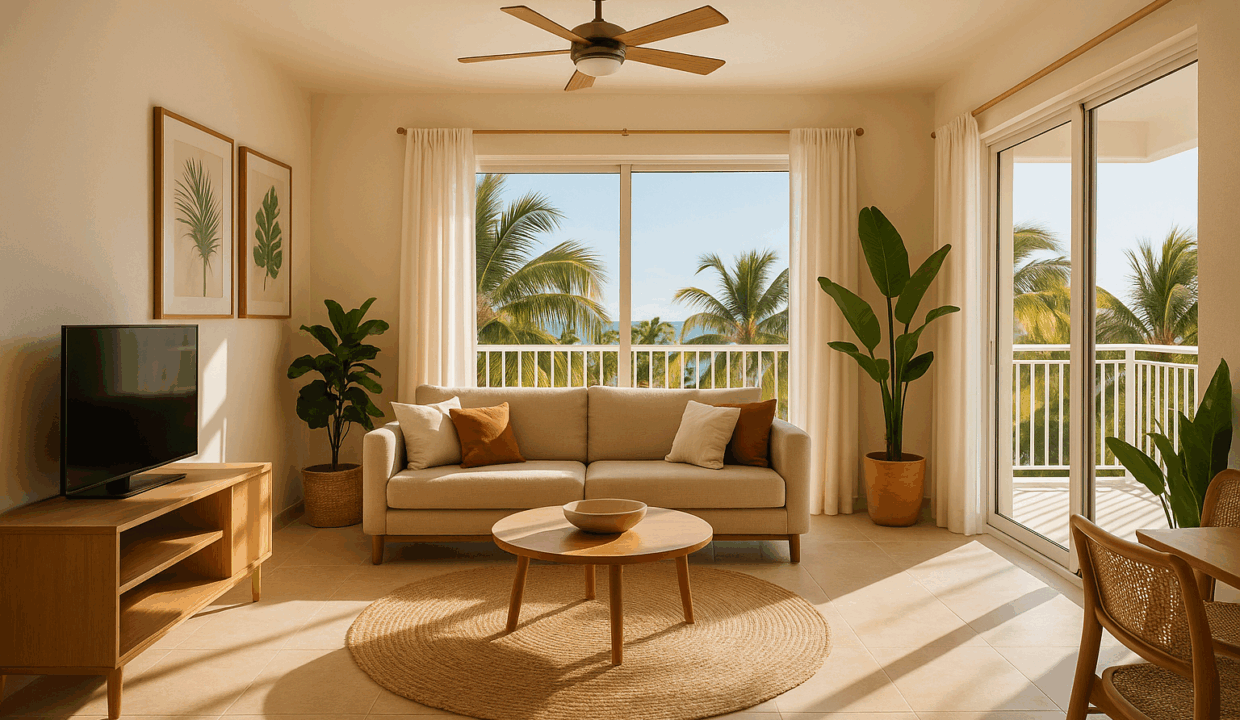

🛠️ What Makes an Airbnb Property Perform Well

Top-performing Airbnb units share common features:

- Modern interiors

- Pool or resort-style amenities

- High-speed internet

- Strong security

- Professional management

- Strategic pricing

✔️ Perez Real Estate validates every property against 2026 guest expectations.

⚠️ Common Airbnb Mistakes — And How We Avoid Them

Typical errors include:

- Buying in the wrong micro-location

- Overestimating occupancy

- Poor furnishing and presentation

- Weak management

- Ignoring seasonality

✔️ Perez Real Estate prevents these mistakes through data-driven selection and ongoing support.

⭐ Conclusion: Airbnb in 2026 Is Profitable — With the Right Strategy

Airbnb remains one of the most profitable real estate strategies in the Dominican Republic in 2026 — when executed properly.

With Perez Real Estate, you benefit from:

- Strategic zone selection

- Secure legal process

- Realistic return projections

- Rental optimization

- Long-term partnership